Novedades

By LFS

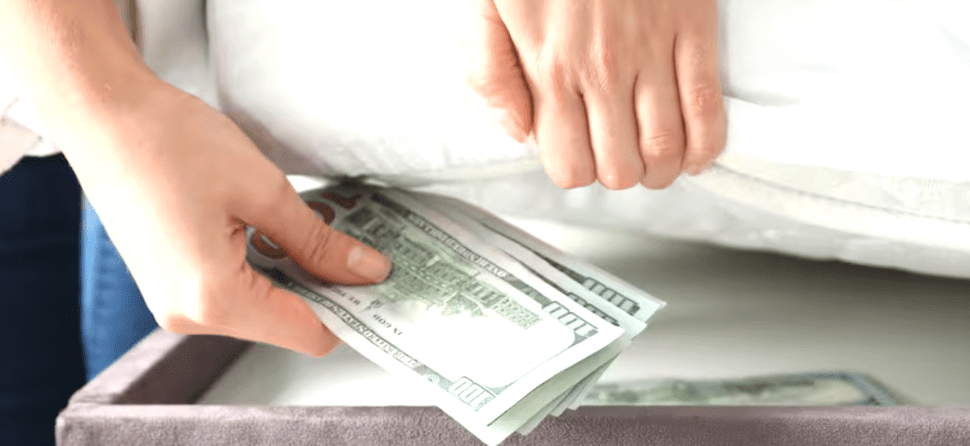

“Permanent popular amnesty”: the fine print of the regime aimed at encouraging dollar disclosure

An article published by La Nación examines the scope of the so-called “permanent popular amnesty”, a regime designed to encourage the disclosure of undeclared dollars through an ongoing adherence mechanism.

The piece focuses on the fine print of the system, its conditions, limitations, and potential tax risks, as well as how it differs from previous amnesty programs. Key aspects include the formal requirements, the applicable tax treatment, and the possible implications in the event of future audits.

In this context, Fernanda Laiún provided technical insight into the scope of the regime and stressed the importance of assessing each case individually before opting in, considering the potential tax and patrimonial risks involved.

The practical implementation and effectiveness of the regime will ultimately depend on the legal certainty provided by the regulatory framework and the level of trust it generates among taxpayers.