Novedades

By LFS

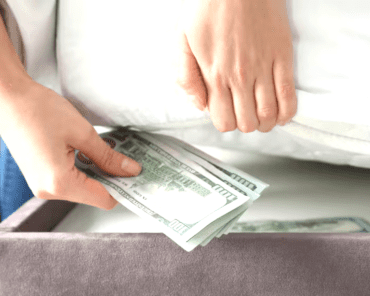

Goodbye to the simplified regime? The dilemma surrounding the Simplified Income Tax Regime

An article published by El Cronista examines the regulation of the Fiscal Innocence Law and the new Simplified Income Tax Regime (RSG), which introduces a so-called “fiscal shield” and reshapes the relationship between taxpayers and the tax authority.

Monotributo taxpayers are excluded from the regime, raising the question of whether leaving the simplified system would be worthwhile.

In this context, Fernanda Laiún noted that the economic differential may not justify the switch: “Monotributo rates were low and only increased significantly in January 2025. Therefore, the savings differential is not substantial.”

However, she highlighted a key risk: the monotributo includes exclusion grounds. “If you incur expenses that cannot be justified under your activity or category, ARCA may exclude you,” she explained.

She also stressed that moving to the general regime would only make sense if the taxpayer expects to exceed the monotributo thresholds (currently ARS 108 million for Category K). Regarding large undeclared savings, she was clear: “It is incompatible for someone within the monotributo system to have generated savings of USD 200,000.”

Ultimately, the decision depends on each taxpayer’s individual situation and projected turnover.